Cokinos | Young is honored to announce that 57 of the firm’s attorneys have been recognized in the 2026 edition of Best Lawyers in America®. This year’s honorees include 37 attorneys named Best Lawyers®, and 20 attorneys earned the title of Best Lawyers: Ones to Watch®.

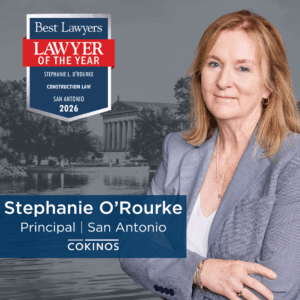

In addition, San Antonio Principal Stephanie O’Rourke has been named 2026 “Lawyer of the Year” for Construction Law in the San Antonio region. Only one lawyer in each practice area and metropolitan area receives this prestigious honor, making it one of the most highly coveted distinctions in the legal profession. Selection is based on exceptional peer-review ratings and reflects outstanding talent, professionalism, and integrity.

“These distinctions underscore the exceptional skill, professionalism, and integrity our attorneys bring to their work every day,” said President and CEO Gregory Cokinos. “We are particularly thrilled to see Stephanie O’Rourke recognized as ‘Lawyer of the Year,’ which reflects her outstanding reputation in the construction law community and her commitment to excellent legal advocacy for our clients.”

“Our clients benefit directly from the deep bench of talent our firm has developed nationwide, and we are proud to see that talent recognized here,” added Founding Principal Marc Young. “This acknowledgment reinforces the trust they place in us every day.”

Since its first publication in 1983, Best Lawyers has been widely regarded as the definitive guide to legal excellence. The recognition is a testament to the respect attorneys earn from their peers within the same practice areas and communities. With its international expansion in 2006, Best Lawyers now publishes rankings in more than 75 countries and continues to be recognized by the profession, the media, and the public as the most reliable and unbiased source for legal referrals.

Cokinos | Young congratulates the following attorneys named Best Lawyers in America®:

- Lauren S. Aldredge – Construction Law

- Johnathan M. Bailey – Construction Law

- David A. Brooks – Real Estate Law

- Travis M. Brown – Construction Law, Insurance Law, Litigation – Construction, and Litigation – Insurance

- Bianca Cedrone – Construction Law

- Craig H. Clendenin – Commercial Litigation

- Gregory M. Cokinos – Commercial Litigation, Construction Law, Corporate Law, and Litigation – Construction

- Stephanie H. Cook – Commercial Litigation, Construction Law, and Litigation – Construction

- Taylor V. Cooksey – Real Estate Law

- Stanley W. Curry – Commercial Litigation, Construction Law, and Litigation – Construction

- Cory M. Curtis – Construction Law

- Chance K. Decker – Commercial Litigation

- Jay K. Farwell – Commercial Litigation, Construction Law, Litigation – Construction, and Litigation – Insurance

- J. Parker Fauntleroy – Construction Law, Litigation – Construction, Personal Injury Litigation – Defendants, and Product Liability Litigation – Defendants

- W. Patrick Garner – Construction Law and Litigation – Construction

- Charles W. Getman – Construction Law and Litigation – Construction

- Anthony T. Golz – Appellate Practice

- John L. Grayson – Construction Law, Litigation – Construction, and Personal Injury Litigation – Defendants

- Gabriel S. Head – Construction Law and Litigation – Construction

- Michael B. Hiddemen – Construction Law and Commercial Litigation

- Philip M. Kinkaid – Real Estate Law

- Beau E. LeBlanc – Admiralty and Maritime Law, Commercial Litigation, Construction Law, and Litigation – Construction

- Dana Livingston – Appellate Practice

- Robert J. MacPherson – Commercial Litigation, Construction Law, and Litigation – Construction

- Shelly D. Masters – Commercial Litigation, Construction Law, and Litigation – Construction

- Robert J. Naudin, Jr. – Construction Law

- Stephanie L. O’Rourke – Commercial Litigation, Construction Law, and Litigation – Construction

- Craig E. Power – Bankruptcy and Creditor Debtor Rights / Insolvency and Reorganization Law and Litigation – Bankruptcy

- Russell W. Smith – Construction Law

- Darrell W. Taylor – Corporate Law and Real Estate Law

- C. Matthew Thompson – Construction Law

- David L. Tolin – Insurance Law

- Christopher C. Wan – Commercial Litigation, Construction Law, and Litigation – Construction

- John C. Warren – Construction Law and Litigation – Construction

- Peter B. Wells, IV – Construction Law, Litigation – Construction, and Personal Injury Litigation – Defendants

- Patrick J. Wielinski – Construction Law, Insurance Law, Litigation – Construction, and Litigation – Insurance

- Marc A. Young – Commercial Litigation, Construction Law, and Litigation – Construction

Cokinos | Young also congratulates the following attorneys earning the title of Best Lawyers: Ones to Watch®:

- Kathleen E. Barrett Madere – Commercial Litigation, Construction Law, and Litigation – Construction

- E. Samuel Crecelius III – Commercial Litigation, Construction Law, and Insurance Law

- Alexandra C. Colby – Construction Law and Litigation – Construction

- Jude K.A. des Bordes – Mass Tort Litigation / Class Actions – Defendants and Personal Injury Litigation – Defendants

- Roland P. Driscoll – Commercial Litigation, Construction Law, and Litigation – Construction

- Alec T. Dudley – Commercial Litigation, Construction Law, Litigation – Construction, and Real Estate Law

- P. Costa Economides – Construction Law and Personal Injury Litigation – Defendants

- Jonah M. Fritz – Construction Law, Litigation – Construction, and Real Estate Law

- Reagan H. Gibbs III – Bankruptcy and Creditor Debtor Rights / Insolvency and Reorganization Law, Commercial Litigation, Construction Law, and Insurance Law

- Blake E. Jones – Commercial Litigation, Construction Law, and Litigation – Construction

- Derek K. Kammerlocher – Construction Law, Corporate Law, Litigation – Construction, and Real Estate Law

- Allegra S. Lezak – Commercial Litigation, Construction Law, and Litigation – Construction

- Matthew J. Longoria – Commercial Litigation, Construction Law, and Litigation – Construction

- Renee M. Mango – Construction Law, Corporate Law, and Insurance Law

- Rachel Moreau-Davila – Commercial Litigation, Construction Law, and Litigation – Construction

- Mitchell R. Powell – Commercial Litigation, Construction Law, Insurance Law, Litigation – Construction, Personal Injury Litigation – Defendants, and Product Liability Litigation – Defendants

- Amy N. Rauch – Insurance Law

- Branson K. Rogers – Commercial Litigation, Construction Law, and Litigation – Construction

- Christian C. Trevino – Commercial Litigation, Construction Law, and Litigation – Construction

- Joseph D. Walker – Commercial Litigation, Construction Law, Litigation – Construction, and Personal Injury Litigation – Defendants

About Best Lawyers

Best Lawyers is the oldest and most respected lawyer ranking service in the world. For 41 years, Best Lawyers has assisted those in need of legal services to identify the lawyers best qualified to represent them in distant jurisdictions or unfamiliar specialties. Best Lawyers awards are published in leading local, regional, and national publications across the globe.

Lawyers who are nominated for consideration are voted on by currently recognized Best Lawyers working in the same practice area and located in the same geographic region. Our awards and recognitions are based purely on the feedback we receive from these top lawyers. Those who receive high peer reviews undergo a thorough verification process to make sure they are currently still in private practice. Only then can these top lawyers be recognized by Best Lawyers.

About Cokinos | Young

Cokinos | Young has led Texas construction and real estate law for over three decades. And today, our 100+ dedicated professionals operate coast to coast and proudly handle all aspects of construction law for owner/developers, project managers, general contractors, design professionals, subcontractors, sureties, and lenders. We provide both dispute resolution and transactional services to clients through all phases of commercial, industrial, pipeline, offshore, civil, and residential construction. Our reputation was built on relentless commitment to client service and the industries we serve, and that remains our primary driver. Dedicated. Resilient. Expertise. That’s Cokinos | Young. Learn more at cokinoslaw.com.

Recent Comments